BALTIMORE — A week after United Healthcare and Johns Hopkins Medicine severed their in-network ties, tens of thousands of patients across Maryland, Virginia and Washington, D.C., are navigating a coverage challenge that could cost them thousands of dollars in out-of-pocket expenses.

The contract dispute between the healthcare giants has left an estimated 60,000 United Healthcare members scrambling to maintain access to their trusted doctors without facing overwhelming costs.

Julie Wigley, WMAR-2 News' assistant creative services director, knows firsthand what's at stake. She has been living with multiple sclerosis since 2010 and requires specialized treatment every six months.

"I am living with MS, so I have an autoimmune disease that I've been dealing with since 2010," Wigley said.

Her infusion treatment carries a steep price tag without insurance coverage.

"The infusion can cost without insurance and without copay assistance can cost over $100,000," Wigley said.

With insurance and assistance through the drug supplier, she pays just $5. When she learned Hopkins could go out-of-network with United Healthcare, she worried about the impact on her care.

"Every doctor I spoke with was like, you'll be fine, they'll come to a resolution. Every person I talked to, you know, this has happened before my insurance did this, they'll come to a resolution. So I tried to just put it in the back of my mind, but of course you're going to think about it," Wigley said.

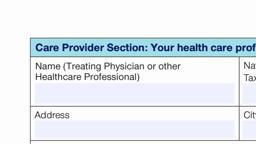

She held out hope until the Aug. 25 deadline. When no deal materialized, she quickly filed paperwork to continue seeing her doctors.

"I have the continuing care form I printed out everything that United Healthcare has. This is what Hopkins sent, you know I have this form. I've read everything," said Wigley as she held up multiple documents. "Most of my doctors responded within 24 hours with a signed form, and I put it in snail mail. We'll see what happens."

United Healthcare's CEO for the Mid-Atlantic region said their top priority is supporting members with serious health conditions but accused Hopkins of refusing to provide standard clinical and physician information required for the continuity process.

“Our top priority at this time is supporting members with serious health conditions who are eligible for continued care at Johns Hopkins. Unfortunately, the health system is refusing to provide the standard clinical and physician information required for this process—information that every other provider in our network shares. This is yet another example of Johns Hopkins putting patients in the middle of our negotiation, seemingly using them as leverage to push for contractual terms that would allow them to deny care at their discretion. We urge Johns Hopkins to share this key information so we can do what’s right for the people we collectively serve.”

A United Healthcare spokesperson said 99% of continuity of care requests were approved but didn't share how many have been processed. These approvals are good for 90 days. And the company hasn't answered whether claims would be retroactively covered if a deal is reached.

Hopkins officials said they've been negotiating in good faith for more than eight months. The vice president of public relations said the dispute isn't about money or administrative issues.

For more than eight months, Johns Hopkins Medicine has negotiated in good faith with UnitedHealthcare, agreeing to their five requests to extend the contract so that we could reach an agreement that puts patients first.

This is not about money, nor is it about small administrative issues. We are negotiating our contract with United so that we can avoid aggressive claim denials that delay necessary care, excessive red tape that forces patients to wait for treatments, and significant payment delays that strain our ability to provide care. We will not sign a contract that allows an insurance company to put profits over patients' health and well-being.

Our patients deserve better than insurance company barriers standing between them and their care. We urge UnitedHealthcare to listen to our concerns in a meaningful way and prioritize what matters most: ensuring patients get the care they need, when they need it, at agreed upon reimbursement.

For patients like Wigley, the stress adds another layer of complexity to managing chronic conditions.

"For not only me, but anyone that's living with a chronic disease, adding on any extra stress can cause so much damage in the long run so it's hard to manage all of that while knowing I'm also dealing with a disease that needs to be managed as well," Wigley said.

Despite feeling powerless in the dispute, Wigley advises patients to be proactive.

"You know, you have to advocate for yourself and not just assume things are going to happen. You need to be the one that is getting out there asking the questions, filling the forms out, sending it in the mail, you know, and keep pushing," she said.

United Healthcare is also in active discussions with Capital Women's Care after their in-network contract expired Aug. 1.

The Maryland Insurance Administration said they're now investigating United Healthcare's network adequacy and continuity of care practices given the recent disputes with the two hospital systems.

State Regulators Explain Patients’ Rights in Hopkins–UnitedHealthcare Contract Battle

MIA staff is available to assist consumers in understanding their rights under state and federal law when their treating provider leaves the network of their insurance carrier. Consumers may contact the MIA at 410-468-2244 or 1-800-492-6116, Extension 2244 to have an investigator explain their rights to them. Or they can file a complaint online.

WMAR-2 News Mallory Sofastaii asked the Maryland Insurance Administration (MIA) to answer key questions about what protections patients have and how they can navigate the fallout from the UnitedHealthcare–Johns Hopkins split. Here’s what the agency told us.

Q: Can you clarify what rights Maryland patients have under state and federal law if their in-network provider suddenly becomes out-of-network during a contract dispute?

A: Marylanders have several important protections when their in-network provider suddenly becomes out-of-network during a contract dispute.

The Federal No Surprises Act requires all group health plans to provide for up to 90 days of continuity of care for certain conditions. (This includes plans that are self-insured. Please note the MIA does not regulate self-insured health plans.) These conditions include individuals who are undergoing treatment for serious and complex conditions, are undergoing institutional or inpatient care, are scheduled to undergo nonelective surgery from the provider, are terminally ill, or are pregnant. MIA can also enforce these requirements for plans that are regulated by the State.

For Maryland regulated plans, state law also requires up to 90 days of continuity of care for primary care providers. Individuals who have questions, regardless of the type of plan they are in, should call MIA at 410-468-2244 or 1-800-492-6116, extension 2244.

Q: For patients whose requests for continuity of care are denied or delayed, what expedited appeal or complaint options can they access through your office, and how quickly can they expect a resolution?

A: Marylanders should immediately contact us if they are having trouble with United on needed continuity of care requests. Please call us with any questions at 410-468-2244 or 1-800-492-6116, extension 2244. We are escalating any requests we receive rapidly and directly with United, and closely monitoring the performance of United with regard to their continuity of care obligations under state and federal law.

Q: What is the Maryland Insurance Administration’s role in protecting patients who are increasingly caught in the middle of these disputes between large insurers and hospital systems?

A: The Maryland Insurance Administration does not have authority to resolve the actual contract dispute. However, the MIA closely monitors the adequacy of health insurers’ networks to ensure compliance with state law. The MIA also enforces continuity of care requirements under state and federal law.

We are also examining areas where our authority could be strengthened in advance of the 2026 legislative session.

Q: Your statement notes that MIA has opened an investigation into UnitedHealthcare’s handling of these disputes. What specifically are you examining, and how could the findings affect patients?

A: We are specifically examining two items:

— the impact of the departure of both Johns Hopkins and Capital Women’s Care on the adequacy of United’s networks, and

— United’s continuity of care practices when providers go out of network.

For the former, though we cannot order a change in networks per se, we can levy significant penalties on insurers who do not have adequate networks to ensure that they have availability of needed providers for their members.

For the latter, we are asking a number of questions about the implementation of United’s continuity of care practices, and will ensure that they are complying with patient requests to the fullest extent of the law.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.