BALTIMORE — It’s open enrollment and you may notice some changes when selecting your health insurance, especially in what you’ll pay.

These increases are largely tied to the expiration of enhanced federal tax credits. According to the Maryland Health Benefit Exchange, many of the 300,000 Marylanders who buy insurance through the state marketplace could see their premiums rise sharply once those credits expire at the end of the year.

To ease the impact, Maryland lawmakers approved a temporary measure to lower costs for some residents. The amount of relief depends on income, but under the state’s Maryland Premium Assistance Program, many enrollees who would otherwise see sharp rate hikes will pay significantly less.

For example, a 30-year-old earning about $39,000 a year who currently pays $61 a month could see that increase to $275 without federal help — but stay around $121 under Maryland’s new program.

Michele Eberle, executive director of the Maryland Health Benefit Exchange, said the law was designed to protect residents who don’t have employer-sponsored insurance.

“Particularly for lower-income folks, we will be able to provide that state subsidy and make up that gap,” Eberle said. “Middle income, we can do about 50 percent. A little bit higher than that, over 400 percent of the federal poverty level — which for a family of four in Maryland is $128,600 — we can’t provide anything. So that’s where you’re going to start to see the significant increases.”

For workers like Bobby Laughlin, Maryland’s marketplace has been a lifeline.

“I have two jobs. I work in a restaurant and then I also do HVAC installation,” Laughlin said.

Neither job offers health insurance, so he buys his plan through Maryland Health Connection.

“The way that works is that I get a really good health insurance plan for a very reasonable price,” he said.

It’s reasonable because he doesn’t pay full price.

“The law recognizes if you don't get your health insurance through your employer, which your employer typically pays 50-60 percent or more towards that, that you need a little help being able to make that monthly premium,” said Eberle.

That help comes through enhanced federal tax credits — discounts funded through taxes consumers would otherwise owe. But those credits expire at the end of the year unless Congress acts, a key issue in the ongoing federal funding standoff.

“I pay under $70, I paid like $68 a month,” Laughlin said.

Without the tax credits, he’d pay around $400.

Maryland’s General Assembly approved a one-year subsidy to soften the blow, bringing his premium closer to $140 instead of $400 — but not everyone qualifies.

Eberle is concerned higher prices could cause people to drop coverage.

“People want health insurance. They want it for themselves. They want it for their families, but if you can't afford it and if you're having to make a decision between food on the table or your health insurance, you know which one will go,” she said.

There are other changes this year, too. DACA recipients — around 300 Marylanders — are no longer eligible for marketplace coverage. Some immigrants with lower incomes will also lose access to premium tax credits, and others may need to submit extra paperwork when enrolling.

Still, Eberle said it’s important for residents to explore their options.

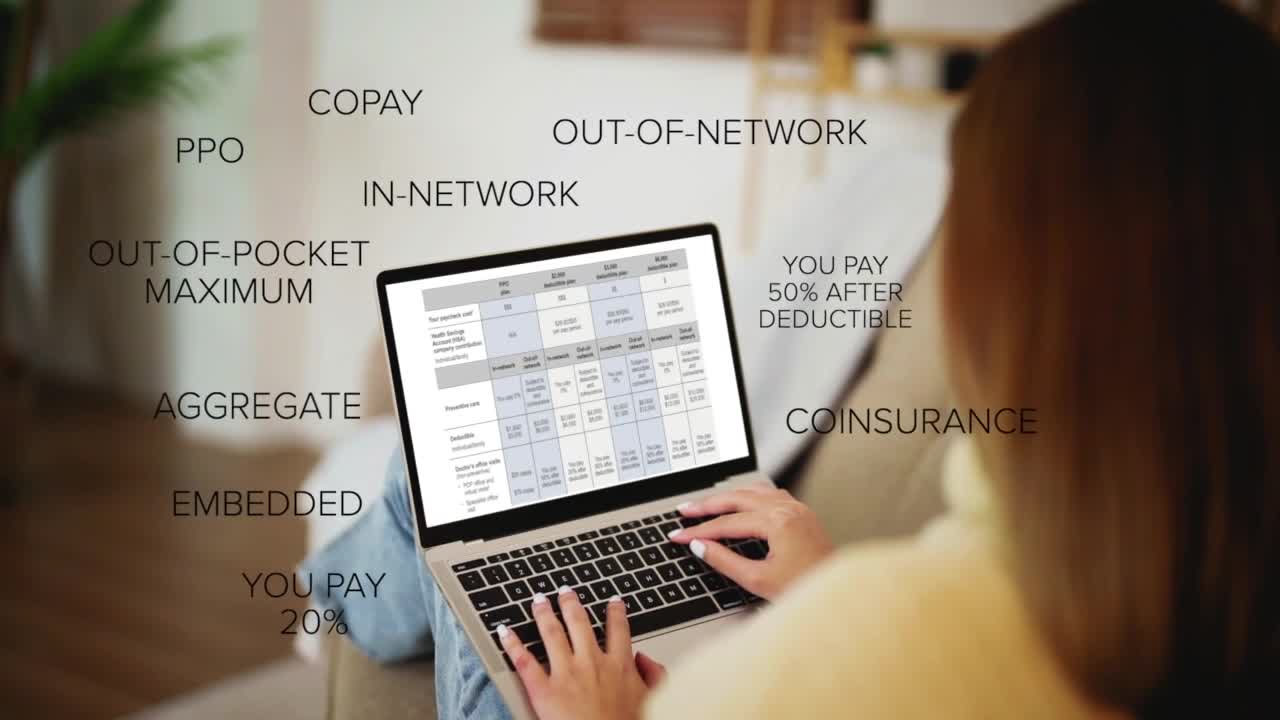

“Even though costs are going up, there still are options. We know they won't be as affordable, but we also want our consumers to know that many of the services that are provided are pre-deductible, no co-pay or co-insurance, a lot of the wellness benefits, getting immunizations, seeing your primary care doctor,” she said.

Bobby said those benefits are what make his plan worth it, and why he doesn’t want to lose them.

“It's great insurance and I, I'm so appreciative for it. I would hate to see it go,” he said.

Eberle said if Congress renews the federal tax credits, Maryland will move quickly to adjust rates — even after the new year begins.

If you’re shopping for coverage through the state marketplace, you have until January 15 to enroll. Eberle recommends acting early, and said navigators are available to help you choose the plan that makes the most sense for you.

To learn more about the Maryland Premium Assistance Program, click here.

And click here to enroll in a plan through Maryland Health Connection.