BALTIMORE — Just over a third of Americans plan to make a health goal as their New Year's resolution. Only around 1 in 4 say they'll make a financial one, according to a WalletHub survey. But financial experts say your wallet deserves more attention in the new year.

In January, many people prioritize waistlines. Loyola University Maryland Professor and Chair of Accounting J.P. Krahel says the focus needs to be on our wallets.

"For your body, do you want to lose weight? Eat less. Do you want to bulk up? Go to the gym. You know what you want to look like later determines what you should be doing now, and that matters for your finances as well," Krahel said.

If your goal is to build wealth, he says the first step is dealing with debt.

"When you're in debt, you've got to see it as if you're in a race. Interest wants to grow the debt. Your payments want to shrink the debt. So if you're not winning that race, and usually by a pretty good margin, then the interest is just going to make it worse. So if you think it's bleak at the end of December, imagine how bleak it's going to be at the beginning of March," Krahel said.

His advice: Start with the debt that has the highest interest rate, not necessarily the biggest balance. The average credit card interest rate is just under 20 percent.

"If I focus on the big guy first, by the time that one's shrunken down, the little guy will have become just as big. I understand it's very tempting to kind of focus on the elephant in the room, but sometimes like the mouse in the room is going to grow much faster, so you've got to kind of prioritize what's going to be a problem rather than what is a problem now," Krahel said.

Staying organized is also critical — particularly with buy now, pay later services. A PayPal survey found half of holiday shoppers planned to use them this season.

"If I have a traditional credit card and I go to 10 stores, I'll still have one credit card bill, and that psychologically and just mechanically it's easier to kind of keep track of. With buy now pay later, I may have 10 different services providing 10 different loans with 10 different rates and terms and deadlines and all that. It's harder to keep track of and you may easily and understandably miss something," Krahel said.

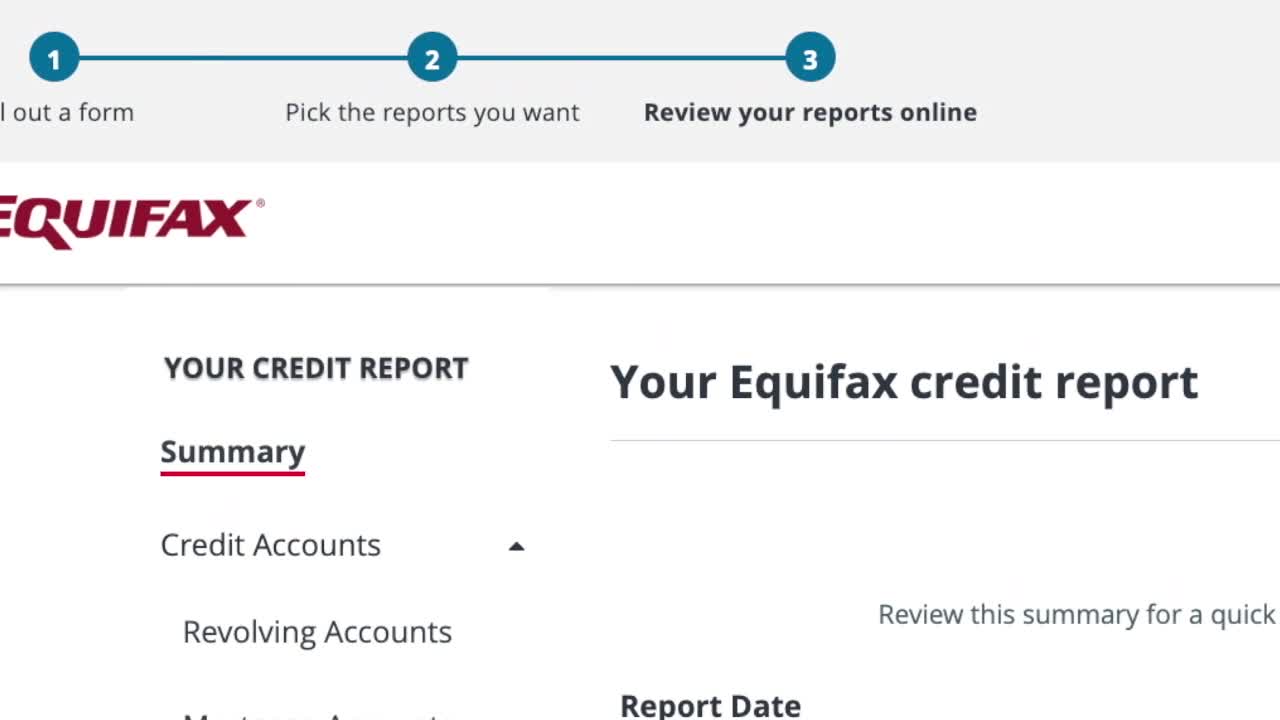

He knows from experience — with a store credit card. While checking his credit through AnnualCreditReport.com, a government-backed service offering free reports from each bureau once per year, he spotted a missed payment.

"And then I forgot about it because it was Christmas, and then I see these red boxes on my credit history. I'm like, oh yeah, but better to let that go for 1 or 2 months than a year," Krahel said.

January is a good time to reevaluate your spending, set a budget, prioritize paying down debt and make sure you're contributing enough to your 401(k) to get your company match. Most importantly, he says, try to give yourself a clean slate.

"Whatever happens in the future with the economy, if I'm not in debt, or at least not in high-interest debt, no matter what happens, I'm going to be better able to weather the storm than somebody who's suffering like I am but also has major interest payments to make," Krahel said.

Other financial goals include a no or low-spend month where you only buy the necessities, setting up automatic transfers to savings and starting contributions to a Roth IRA or 529 college savings plan.

Krahel says to set a date for when you want to be debt free then work backwards. Credit card payment calculators can help you map out the steps. Or click here for additional New Year's money resolutions.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.